The Paradigm Shift in Risk Assessment

The Evolving Landscape of Risk Factors

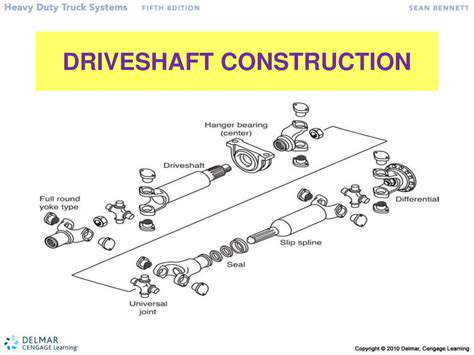

Autonomous vehicles, while promising a future of safer roads, introduce a novel set of risk factors that require a paradigm shift in how insurers assess and manage risk. The traditional reliance on human driver behavior as the primary determinant of risk needs to be augmented with an understanding of vehicle performance, software glitches, and external factors impacting autonomous systems. This necessitates a detailed analysis of potential malfunctions, including sensor failures, communication breakdowns, and unexpected environmental conditions, all of which could lead to accidents and necessitate significant insurance payouts.

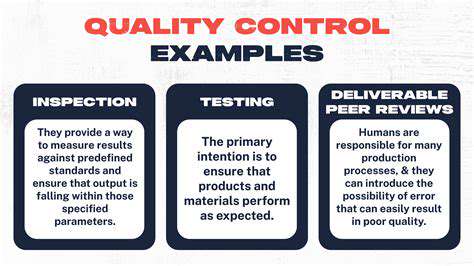

Traditional risk assessments, often focused on driver demographics and driving history, are proving insufficient. Insurers need to develop new metrics and models that incorporate the unique characteristics of autonomous vehicles, their software, and the environment in which they operate. This includes factors such as the vehicle's manufacturer, the specific software version, and the vehicle's real-time performance data, all of which can dramatically impact the likelihood and severity of an accident.

The Impact of Vehicle-to-Vehicle Communication

The integration of vehicle-to-vehicle (V2V) communication technologies promises enhanced safety by enabling vehicles to share real-time information. However, this technology also introduces new complexities in risk assessment. Insurers must determine how to account for the reliability and accuracy of this communication network. Malfunctions or disruptions in V2V communication could significantly impact a vehicle's ability to react to hazardous situations, potentially leading to accidents that are difficult to attribute solely to one driver or vehicle.

Furthermore, the sheer volume of data exchanged between vehicles demands sophisticated analytical tools to identify patterns and anomalies. Insurers need to develop robust data management systems and algorithms to process this data, allowing them to assess the risk associated with different communication protocols and their reliability in various environmental conditions. This intricate process will undoubtedly require significant investment in new infrastructure and expertise.

Software Glitches and Cyberattacks

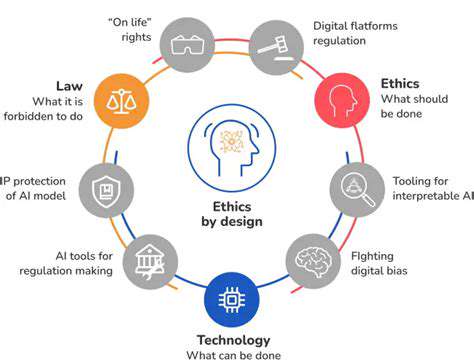

Autonomous vehicles are highly complex systems relying heavily on software. The potential for software glitches, vulnerabilities, and cyberattacks poses a significant risk that traditional insurance models struggle to account for. Insurers need to develop innovative methods to assess the risk associated with software updates, potential hacking attempts, and the overall stability of the vehicle's software. This includes evaluating the robustness of the software development process and the efficacy of cybersecurity measures implemented by vehicle manufacturers.

The potential for a malicious actor to exploit vulnerabilities in the autonomous vehicle's software to cause an accident necessitates a comprehensive approach to risk mitigation. This includes not just assessing the likelihood of such an attack but also the potential severity of the resulting accident, which may be significantly higher than traditional accidents due to the unpredictability of the malicious intent.

Adjusting Coverage and Premiums

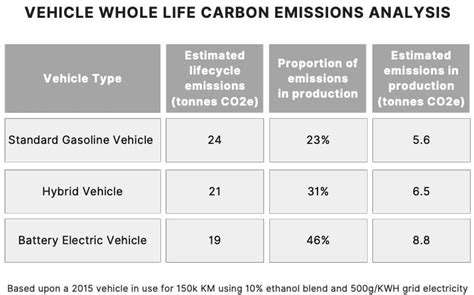

The paradigm shift in risk assessment necessitates adjustments to insurance coverage and premiums. Insurers need to determine how to allocate liability in accidents involving autonomous vehicles, considering the complex interplay of vehicle performance, software malfunctions, and external factors. This will require establishing new insurance products that better reflect the unique characteristics of autonomous vehicles and their potential liabilities. Insurers must carefully consider how to adjust coverage based on the level of autonomy, the vehicle's software updates, and the driver's level of interaction with the vehicle.

Premiums will likely be influenced by factors like the vehicle's safety features, the manufacturer's reputation for software quality, and the vehicle's performance history. Furthermore, assessing the impact of various safety regulations and government guidelines on insurance premiums will be crucial to maintaining a stable and equitable insurance market for autonomous vehicles.

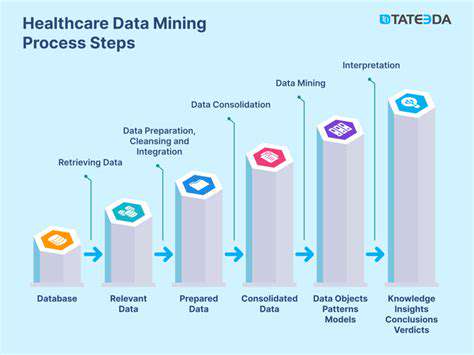

The Role of Data and Machine Learning

The sheer volume of data generated by autonomous vehicles offers a unique opportunity to refine risk assessment models. By leveraging machine learning algorithms, insurers can analyze vast datasets to identify patterns and predict potential risks. This data can encompass sensor data, driving behavior patterns, software performance logs, and external environmental factors. This will allow insurers to develop more accurate risk profiles for individual vehicles and drivers, leading to more personalized insurance premiums and tailored coverage options.

Furthermore, the use of machine learning and big data analytics can be instrumental in identifying potential software vulnerabilities and predicting the likelihood of malfunctions. By continuously monitoring and analyzing real-time data, insurers can proactively identify and address emerging risks, thereby ensuring a more robust and responsive risk assessment process for autonomous vehicles.