Benefits for Drivers

Improved Safety

Enhanced safety features, such as advanced driver-assistance systems (ADAS), are key benefits for drivers. These systems, often including features like automatic emergency braking and lane departure warnings, can significantly reduce the risk of accidents. Proactive safety measures like these can help drivers avoid collisions and minimize the severity of potential incidents. This translates to a safer driving experience overall, protecting both the driver and other road users.

Furthermore, improved vehicle design with better visibility and ergonomic controls contributes to a safer driving environment. Drivers benefit from clear sightlines and intuitive controls that reduce distractions and allow for more focused attention on the road ahead.

Reduced Stress and Fatigue

Modern vehicles often incorporate features that help reduce driver stress and fatigue, particularly on long journeys. Adaptive cruise control, for example, can maintain a consistent speed and distance from the vehicle ahead, easing the workload on the driver and preventing unnecessary acceleration and braking. This can lead to a more relaxed and less stressful driving experience, especially for those on long commutes.

Features like automated lane keeping assist and steering support can also reduce driver fatigue by taking over some of the steering tasks. This is particularly helpful during monotonous driving conditions, such as long stretches of highway driving. This can contribute to improved alertness and reduced risk of driver errors.

Enhanced Convenience and Efficiency

Modern vehicles offer a wealth of convenience features that streamline the driving experience. Integrated navigation systems, infotainment features, and smartphone integration allow drivers to stay connected and informed while on the road. These technological advancements make driving more convenient and efficient. This allows drivers to stay focused on the road, reducing distractions and improving overall driving efficiency.

Features such as keyless entry, automatic climate control, and hands-free calling are examples of how convenience features enhance the driver experience, making daily commutes smoother and more enjoyable.

Economic Advantages

Fuel efficiency improvements in modern vehicles translate to significant economic advantages for drivers. Reduced fuel consumption leads to lower fuel costs, saving drivers money over the lifetime of the vehicle. This is particularly important in today's economic climate, where fuel prices can fluctuate dramatically. Efficient driving, aided by advanced technologies, directly correlates with these savings.

Furthermore, some vehicles offer the potential for lower insurance premiums due to enhanced safety features. This is a direct benefit for drivers, often translating into savings in the long run. Lower insurance costs directly offset some of the initial investment costs associated with a newer vehicle.

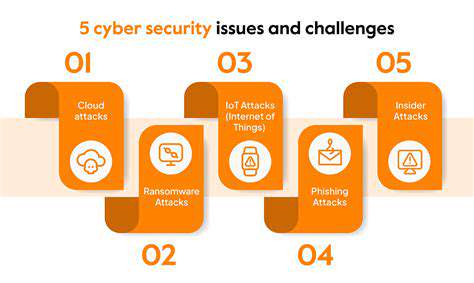

Challenges and Considerations

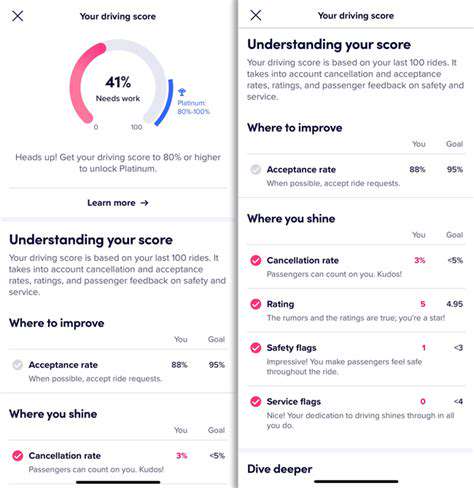

Understanding Usage-Based Insurance Models

Usage-based insurance (UBI) models for connected cars are fundamentally changing the way insurance is structured. Instead of relying solely on factors like age and location, These models incorporate driving behavior data, such as acceleration, braking, speed, and route patterns. This data, collected through onboard telematics systems in connected vehicles, allows insurers to assess risk more accurately, potentially leading to significant changes in premiums.

The core principle behind UBI is that safer drivers pay less. By analyzing real-world driving habits, insurers can differentiate between drivers who tend to drive cautiously and those with more aggressive driving styles. This allows for a more personalized approach to insurance pricing, moving away from a one-size-fits-all model.

Data Privacy and Security Concerns

Collecting and utilizing driving data raises significant privacy and security concerns. Consumers need assurance that their personal information, including driving habits, will be handled responsibly and securely. Robust data encryption and secure storage protocols are essential to protect sensitive data from unauthorized access or breaches.

Transparency in data usage is also critical. Consumers should be clearly informed about how their data is being collected, used, and protected. Detailed privacy policies and clear explanations of how data impacts insurance premiums are vital for building consumer trust.

The Impact on Premium Variability

One of the major implications of UBI is the potential for substantial variability in insurance premiums. Drivers with consistently safe driving habits can expect lower premiums, while those with more risky driving behaviors may face higher premiums. This shift towards personalized pricing can be a significant motivator for drivers to improve their driving practices. However, this variability also presents a challenge for those who may experience unpredictable fluctuations in their premiums due to temporary or situational factors.

Understanding how these factors contribute to the variability of premiums is crucial for consumers to make informed decisions and potentially mitigate any unexpected increases in their insurance costs.

Implementation Challenges and Technological Hurdles

Implementing UBI models requires overcoming various technological and logistical hurdles. Ensuring accurate and reliable data collection across a wide range of vehicle models and telematics systems is a significant undertaking. Developing robust algorithms to analyze and interpret the vast amounts of data generated by connected cars is also a crucial aspect of successful UBI implementation. The ongoing development and refinement of these algorithms are essential to ensuring the accuracy and fairness of the insurance pricing models.

The need for widespread adoption of connected car technology is another key consideration. If a substantial portion of the vehicle population does not have the necessary technology or connectivity, the value of UBI models could be significantly limited.

Consumer Acceptance and Education

Consumer acceptance and education are vital components of a successful UBI implementation. Drivers need to understand how their driving behavior impacts their premiums and what steps they can take to improve their scores. Educational initiatives and clear communication from insurers are paramount in fostering trust and ensuring that consumers are actively involved in managing their insurance costs.

Addressing potential misunderstandings and concerns about data privacy and the accuracy of the algorithms used to assess driving behavior is essential. Building trust through transparent communication and providing accessible resources for drivers to learn about UBI models is crucial for their successful integration into the insurance industry.