Data Collection Methods for UBI

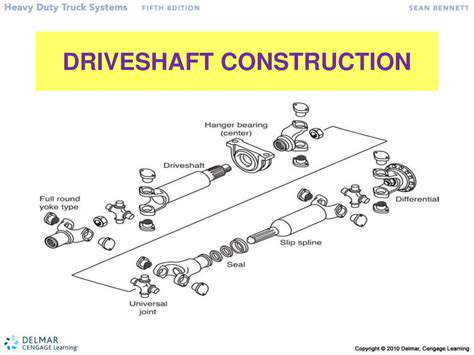

A crucial aspect of usage-based insurance (UBI) is the meticulous collection of data. This data, encompassing a wide range of driving behaviors, is pivotal in accurately assessing risk profiles. Various methods are employed to gather this information, from sophisticated telematics devices embedded in vehicles to mobile applications that track driving patterns. These systems continuously monitor speed, acceleration, braking, and location, providing a comprehensive picture of the driver's habits. The data collected is essential for insurers to understand the nuances of individual driving styles and tailor premiums accordingly.

Beyond in-vehicle devices, data can be collected through GPS tracking, smartphone integration, and even through interactions with traffic management systems. The goal is to capture a rich dataset that reflects the complexities of real-world driving conditions and individual driving behaviors. Accurate data collection forms the bedrock of a robust UBI program, ensuring that premiums reflect the actual risk associated with each driver.

Analyzing Driving Behavior Data

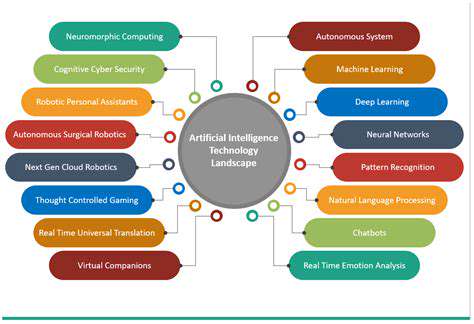

Once the data is collected, the next critical step involves analyzing it to identify patterns and trends. Sophisticated algorithms and statistical models are employed to extract meaningful insights from the vast amounts of data generated. This analysis helps insurers understand how different driving behaviors correlate with accident rates and other relevant metrics. For example, patterns of aggressive driving, such as speeding and harsh braking, can be identified and associated with higher accident probabilities.

The analysis process also considers factors beyond immediate driving behavior. Data like the driver's location, time of day, and road conditions are analyzed to provide a more nuanced understanding of risk. This comprehensive analysis is crucial for accurately assessing risk and developing personalized insurance premiums for each driver.

Developing Predictive Models

By analyzing historical data, insurers can develop predictive models that forecast future accident risks. These models are trained on the collected data, learning to identify patterns and correlations between driving behaviors and accident occurrences. This process allows insurers to anticipate potential risks and adjust premiums accordingly, promoting a fairer and more efficient insurance system.

The accuracy of these predictive models is paramount. Continuous refinement and validation are essential to ensure that the models remain relevant and effective in reflecting the complexities of real-world driving behaviors and accident probabilities. The ability to accurately predict future risk is fundamental to the success of a UBI program.

Personalizing Insurance Premiums

A key objective of UBI is to personalize insurance premiums based on individual driving behavior. By analyzing the data collected through telematics, insurers can identify drivers with lower accident risks and offer them lower premiums. Conversely, drivers with higher accident risks will be charged accordingly.

This personalized approach to insurance pricing is more equitable and reflects the actual risk each driver poses. It promotes responsible driving habits and incentivizes safer driving practices. It's a significant advancement in insurance, moving away from generalized risk assessments towards a more tailored and accurate approach.

Improving Safety and Road Usage

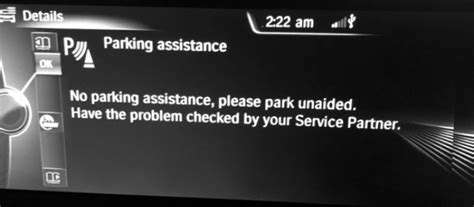

The data collected through UBI systems can contribute significantly to improving road safety and enhancing traffic management. Analyzing patterns of driving behaviors can identify areas where road infrastructure improvements are needed. For example, dangerous intersections or poorly lit roadways might be highlighted by the data, prompting safety interventions.

Challenges and Ethical Considerations

While UBI holds considerable promise, there are also challenges and ethical considerations to address. Ensuring data privacy and security is crucial, as is addressing potential biases in the algorithms used to analyze driving data. Transparency in how data is collected, used, and analyzed is essential for building trust among consumers.

Furthermore, there are concerns about potential discrimination based on socioeconomic status or other factors that could influence driving patterns. It's vital to develop robust guidelines and regulations to mitigate these risks and ensure that UBI programs are implemented fairly and ethically.

The Future of UBI

The future of usage-based insurance is promising, with ongoing advancements in telematics technology and data analysis techniques. As technology evolves, the potential for even more personalized and accurate risk assessment increases. This could lead to further refinements in premium structures, offering drivers even greater control over their insurance costs.

The integration of UBI with other emerging technologies, such as autonomous vehicles, will further shape the future of insurance. This promises to be an exciting period of innovation, with the potential to create a more efficient, equitable, and customer-centric insurance system.