Introduction to State-Specific Car Sales Taxes

Understanding State-Specific Car Sales Taxes

State-specific car sales taxes are a crucial factor in the overall cost of purchasing a vehicle. These taxes, levied by individual states, vary considerably and can significantly impact the final price. Understanding how these taxes work is essential for anyone looking to buy a car, as it allows for informed budgeting and comparison shopping across different states. Knowing the tax rate in advance helps buyers plan their finances and avoid surprises at the dealership.

These taxes are often calculated as a percentage of the vehicle's sale price, and they vary not only by state but also by specific city or county in some cases. This complexity underscores the importance of thorough research before making a purchase. Factors beyond the simple percentage can influence the actual tax amount, such as the vehicle's classification and any applicable exemptions.

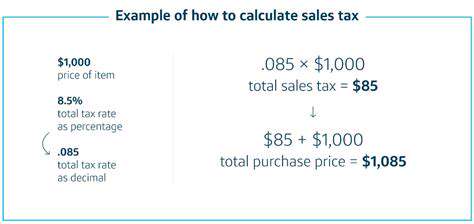

Calculating the Tax Burden

Calculating the exact tax burden involves more than just multiplying the sale price by the tax rate. Variations in the tax rate, as mentioned previously, can significantly impact the final cost. Different states have different methods of calculating the tax, which can further complicate the process. For example, some states may apply the tax to the sticker price, while others may calculate the tax on the price after any negotiated discounts or trade-in values. This nuance makes it important to clarify the specific method with the seller or consult state resources.

To ensure accurate calculations, buyers should always confirm the applicable tax rate with the relevant state authorities or consult reliable online resources. This careful calculation is essential for budgeting and avoids costly surprises at the time of purchase. This proactive approach can prevent financial shocks by having a clear picture of the total cost.

Factors Influencing Tax Rates

Several factors contribute to the variation in car sales tax rates across states. These include the state's overall fiscal needs, its economic standing, and even political considerations. The tax rates aren't static; they can change over time in response to budgetary demands or policy shifts. Understanding these influences allows buyers to appreciate the complexity behind the numbers.

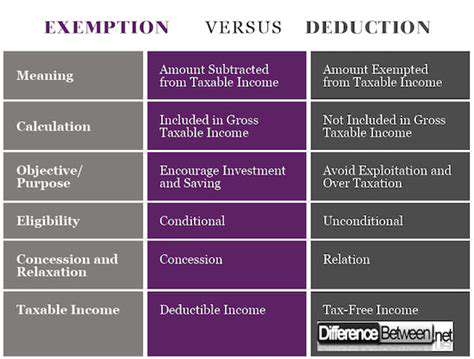

Exemptions and Deductions

While car sales taxes are generally applied to the purchase of a new or used vehicle, there are sometimes exemptions or deductions. These can vary considerably based on the individual state's regulations. For instance, some states offer exemptions for certain types of vehicles, like those used for specific purposes or by people with disabilities. Researching these exemptions is essential to determine if any apply to your situation.

It's crucial to consult with the appropriate state agencies or tax professionals to understand the precise details of any applicable exemptions or deductions. Knowing these potential advantages can significantly affect the final cost of the vehicle.

Navigating Online Resources

Fortunately, the internet offers a wealth of information to help navigate the complexities of state-specific car sales taxes. Numerous websites and online tools provide detailed information on tax rates, regulations, and calculation methods for each state. These resources can be invaluable in comparison shopping across different locations.

Using these online resources allows buyers to compare tax burdens across states before making a decision. This empowers buyers to make informed choices and avoid potentially high costs. It's essential to verify the accuracy of the information found online with official state government sources.

The Impact on Car Purchasing Decisions

State-specific car sales taxes are a significant element in the overall cost of car ownership. Awareness of these taxes is essential for effective budgeting and comparison shopping. Knowing the tax rates and potential exemptions can significantly affect purchasing decisions, allowing buyers to compare the total cost of a vehicle in different states. Understanding the tax structures will enable consumers to make informed choices that align with their financial plans.

Ultimately, the inclusion of car sales tax in the total cost of a vehicle necessitates a thorough understanding of the specific regulations in each state. This knowledge allows for a more strategic and financially responsible car-buying experience.

Exemptions and Deductions from Sales Tax

Exemptions for Dependents

Exemptions for dependents are crucial for reducing your tax burden. These allowances are granted for individuals who are financially supported by you. Understanding the criteria for dependent exemptions is essential to ensure you claim the correct amount. This involves verifying the dependent's relationship to you and confirming their financial dependence on your income.

There are specific rules and guidelines regarding the types of dependents eligible for exemptions. These vary depending on the country's tax laws and regulations. Thorough research and consultation with a tax professional can prevent costly errors.

Standard Deductions

Standard deductions represent a fixed amount that reduces your taxable income. This pre-calculated deduction simplifies the tax calculation process, and is a valuable tool for taxpayers. It's often a more straightforward approach than itemizing your deductions.

The standard deduction amount often varies based on your filing status. This means that married couples filing jointly typically receive a higher standard deduction than single filers.

Itemized Deductions

Itemized deductions allow taxpayers to account for specific expenses that reduce their taxable income. These expenses are often categorized as those related to homeownership, charitable contributions, and medical expenses. Careful documentation and accurate record-keeping are essential to maximize these deductions.

Itemizing can sometimes result in a higher deduction than the standard deduction, depending on your financial situation. However, it requires more detailed record-keeping and effort.

Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to deduct the interest they paid on their student loans. This deduction is specifically designed to provide a financial incentive for higher education and investing in human capital. This deduction can significantly reduce the tax burden for individuals with substantial student loan debt.

Charitable Contributions

Donations to qualified charities are often deductible. This allows individuals to contribute to causes they believe in while potentially reducing their tax liability. Proper documentation of these contributions is crucial for claiming the deduction. This includes receipts and other supporting evidence.

The amount that can be deducted often has limits and specific rules. These rules differ based on the type of charity and the nature of the donation.

Medical Expenses

Medical expenses exceeding a certain threshold can sometimes be deducted. These deductions can be claimed for expenses related to healthcare, prescriptions, and other medical treatments. It's important to maintain thorough records of these expenses for accurate deduction calculations.

These records can include receipts, medical bills, and other supporting documents.

Home Mortgage Interest Deduction

The home mortgage interest deduction is a significant benefit for homeowners. It allows taxpayers to deduct the interest paid on their home mortgage. This deduction can substantially reduce the tax burden for homeowners. It's an important consideration for anyone seeking to minimize their tax liability.

However, there are often limits and restrictions on the amount that can be deducted. These often depend on the type of loan and the amount borrowed.