The Rise of Data-Driven Insurance

The Changing Landscape of Insurance

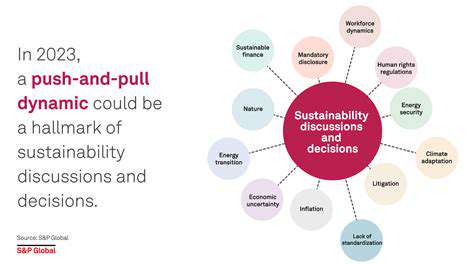

The insurance sector is experiencing a profound shift as data becomes more abundant and accessible. Traditional underwriting methods, claims handling, and customer engagements are being reshaped by this deluge of information. This move toward data-centric approaches is fundamentally altering insurer operations, paving the way for more streamlined and individualized services. Older techniques depended largely on past data and human judgment, frequently causing inefficiencies and potentially unfair results.

Today's insurers can gather and examine massive datasets from diverse origins—customer behaviors, socioeconomic indicators, and even weather patterns. This holistic risk perspective enables a deeper comprehension of personal and group risks, allowing for fairer, more customized pricing structures.

Data Analytics in Underwriting

Modern underwriting heavily relies on data analytics. By scrutinizing extensive datasets, insurers can spot trends that forecast future claims, letting them modify premiums and coverage precisely. This analytical method empowers insurers to craft more competitive, bespoke insurance offerings, potentially boosting market presence and customer happiness.

Advanced algorithms can detect previously ignored risk elements, yielding more precise claim predictions. Both insurers and policyholders benefit financially as premiums reflect personal risk rather than broad demographic assumptions.

Personalized Insurance Products

Individual data analysis enables insurers to provide highly tailored coverage solutions. Customers receive plans specifically designed for their unique circumstances and risk factors. This customization strengthens client satisfaction and retention, fostering deeper insurer-policyholder relationships.

Insurance offerings can now address particular needs—safe drivers might earn discounts, while specialized occupational coverage becomes possible. Such personalization also creates opportunities in niche markets, expanding insurers' potential client pools.

Improved Claims Processing

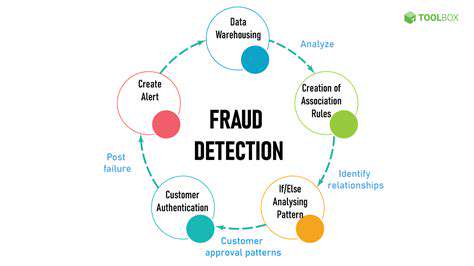

Data insights revolutionize claims handling. Predictive analytics allow insurers to foresee and mitigate potential claims, reducing overall claim volumes. This efficiency means quicker resolutions and happier customers. Real-time analysis helps detect fraud and simplifies the entire claims procedure.

Moreover, claim pattern analysis reveals systemic issues or emerging risks, enabling proactive risk strategy adjustments that may prevent future claims and enhance operational effectiveness.

The Future of Data-Driven Insurance

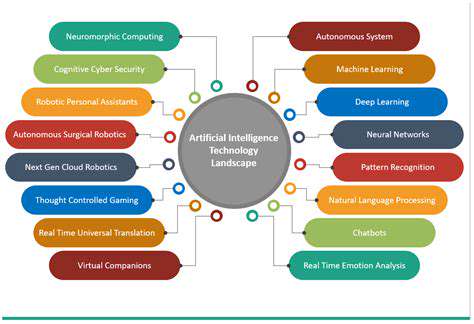

Insurance's future is data-bound. Technological progress will enable insurers to harness increasingly complex datasets and sophisticated algorithms for hyper-personalized products and optimal risk management. These advancements promise innovative, efficient insurance solutions.

AI and machine learning integration will profoundly influence the sector, potentially birthing completely novel coverage models. The possibilities for customized, proactive, and efficient services are immense, heralding a more client-focused, cost-efficient insurance landscape.

Enhanced Safety Features and Reduced Accidents

Enhanced Safety Features and Accident Reduction

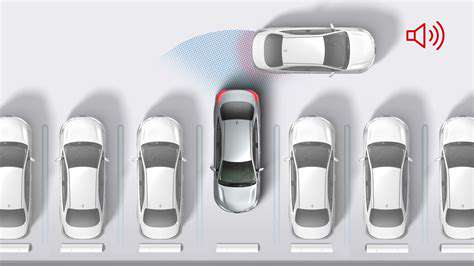

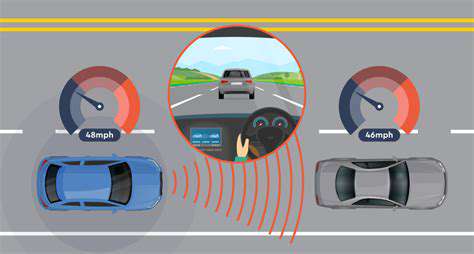

Connected vehicle technology is revolutionizing auto safety. By linking cars to real-time data networks, manufacturers implement advanced driver-assistance systems (ADAS) that dramatically lower accident risks. Features like automatic emergency braking, lane departure alerts, and adaptive cruise control constantly monitor road conditions, intervening to prevent or lessen collisions. The outcome? Safer roads for all users.

Improved Driver Awareness and Response

Connected systems supply drivers with vital alerts and information, heightening situational awareness. Instant traffic updates, weather reports, and hazard warnings enable proactive route adjustments, potentially avoiding dangerous scenarios entirely. This continuous information flow helps motorists make smarter decisions and respond swiftly to changing conditions.

Predictive Maintenance and Proactive Repairs

Beyond safety, connected technology enables preventative maintenance. Vehicle sensors monitor performance continuously, flagging potential issues before they cause breakdowns or accidents. This predictive capability ensures timely repairs, preventing costly emergencies while extending vehicle lifespan and reducing mechanical failure-related accidents.

Data-Driven Accident Analysis and Prevention

Connected vehicles generate vast accident-related data. Insurers analyze this information to identify risky behaviors and develop targeted interventions. This evidence-based approach informs safer road designs and more effective driver education programs, demonstrably reducing accidents. Insurers also leverage this data for more accurate risk evaluations.

Reduced Insurance Costs and Premium Savings

By decreasing accident frequency and severity, connected technology lowers insurance expenses. Improved safety features and preventative maintenance create lower-risk profiles, potentially reducing premiums for safety-conscious drivers. These financial benefits directly result from connected vehicles' accident-reducing capabilities.

Enhanced Customer Service and Support

Connected technology also improves customer support. Drivers access remote diagnostics and assistance through in-car systems, meaning faster issue resolution, less downtime, and better problem-solving. From roadside help to maintenance alerts, connected vehicles create a smoother, more supportive ownership experience.

Navigating the Challenges of Data Privacy and Security

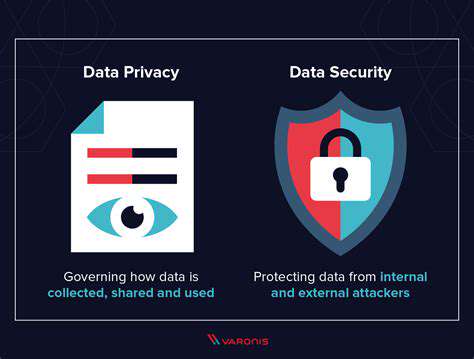

Data Collection and Integrity

Accurate, reliable data forms the foundation of meaningful analysis. Collection methods must align with research goals while ensuring consistency. Establishing rigorous protocols maintains data quality and minimizes errors. Without integrity, data leads to flawed conclusions and resource waste.

Source evaluation is equally critical. Are sources trustworthy and representative? Recognizing each source's limitations prevents misinterpretation. Consider sample sizes, potential biases, and collection errors carefully.

Data Storage and Management

Effective data utilization requires smart storage solutions. Cloud or on-premises options must balance scalability, security, and accessibility. Proper storage ensures authorized access while protecting sensitive information. Comprehensive management includes backup and recovery plans to safeguard against data loss.

Metadata creation remains essential for organized, retrievable data. Well-maintained metadata enhances usability for all stakeholders, making information easier to locate and understand for future analysis.

Data Analysis Techniques

Choosing appropriate analytical methods unlocks data's potential. Different approaches—statistical models, machine learning, visualizations—each have strengths and weaknesses. Matching techniques to data characteristics and research questions yields valid, reliable results. This demands deep understanding of both data and objectives.

Ethical considerations must guide analysis. Conduct research with transparency, avoiding manipulation or misrepresentation. Always acknowledge methodological limitations and potential biases.

Data Presentation and Communication

Clear data communication bridges the gap between analysis and action. Well-designed charts and graphs transform complex information into digestible visuals. Effective visualizations immediately convey patterns and relationships, helping audiences grasp key insights. Tailor presentations to audience needs for maximum impact.

Compelling, actionable presentations drive decision-making. Reports, dashboards, or slide decks should highlight crucial findings and recommended actions, enabling stakeholders to respond appropriately to the data's implications.