State governments play a significant role in promoting EV adoption through a variety of incentives. These programs can encompass a range of benefits, including tax credits, rebates, and even funding for charging infrastructure. The nature and scope of these incentives vary considerably from state to state, reflecting diverse priorities and economic conditions. To fully understand the benefits available in your region, it's crucial to research the specific regulations and incentives offered by your state's Department of Transportation or similar agencies.

Some states offer substantial incentives that complement the federal ones, making EVs even more affordable. Others may focus on specific types of EVs or charging infrastructure development. This diversity in state-level programs underscores the importance of conducting thorough research based on your location to identify the most applicable and advantageous opportunities for purchasing or owning an electric vehicle. The incentives can significantly vary in value, from small rebates to substantial tax credits.

Maximizing Your Savings: Combining Federal and State Incentives

Combining federal and state incentives can yield substantial savings for EV buyers. Careful planning and research are essential to maximize the financial benefits available. By understanding the eligibility requirements for both federal and state programs, consumers can leverage these opportunities to reduce the overall cost of their EV purchase. This combined approach can make electric vehicles more accessible and attractive to a broader range of consumers.

The interplay between federal and state incentives creates a complex but potentially rewarding financial landscape for EV buyers. By understanding the specific rules for each level of government, individuals can potentially save a significant amount of money on their EV purchase. This combined financial support can be a driving force in accelerating the transition to electric vehicles and fostering a more sustainable transportation future.

Eligibility Criteria and Application Procedures

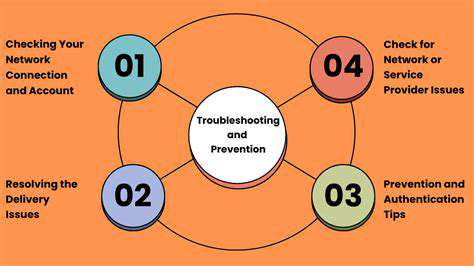

Specific eligibility criteria for federal and state EV incentives vary. Factors such as vehicle type, battery capacity, and manufacturer play a significant role in determining eligibility. The application procedures often involve submitting documentation, such as proof of purchase and vehicle specifications, to the appropriate government agencies. Thorough research and adherence to the guidelines are essential for a smooth and successful application process.

Understanding the application process and eligibility requirements for both federal and state incentives is crucial for maximizing savings on EV purchases. Carefully reviewing the specific guidelines and documentation requirements for each program is essential. Seeking professional advice or consulting with financial advisors specializing in EV incentives can also prove invaluable in navigating the complexities of these programs and ensuring successful application.

State-Level Incentives: A Regional Breakdown

State Incentives for Economic Growth

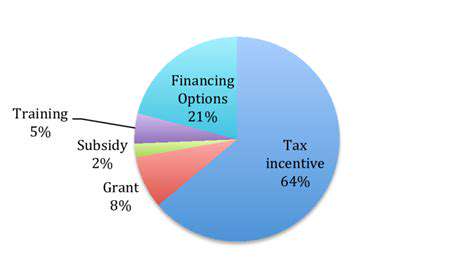

State-level incentives play a crucial role in attracting businesses and fostering economic growth within specific regions. These incentives often take the form of tax breaks, grants, or subsidized infrastructure projects, designed to stimulate investment and create jobs. Understanding the nuances of these programs is essential for businesses considering relocating or expanding operations, as well as for policymakers seeking to optimize economic development strategies. Incentives can significantly impact a region's economic trajectory and competitiveness.

A comprehensive analysis of state-level incentives must consider not only the specific types of incentives offered but also the broader economic context of the region. Factors such as existing industry clusters, workforce skills, and access to transportation networks all contribute to the overall attractiveness of a location for businesses. Furthermore, the effectiveness of incentives is often debated, with some critics arguing that they can be wasteful and ineffective if not carefully designed and implemented.

Regional Variations in Incentive Strategies

Incentive strategies vary significantly across different regions and states. Some states focus on attracting high-tech industries, providing tax credits for research and development, or offering grants for the development of specialized infrastructure. Others prioritize manufacturing, providing tax breaks for new facility construction or offering workforce training programs. The specific approach adopted often reflects the unique strengths and challenges of a region.

This regional variation in incentive strategies highlights the importance of tailoring economic development plans to specific circumstances. A one-size-fits-all approach is unlikely to be effective, as the needs and priorities of different regions differ greatly. Understanding these regional variations is crucial for maximizing the impact of incentives and promoting sustainable economic growth.

Evaluating the Effectiveness of State Incentives

Assessing the effectiveness of state-level incentives is a complex undertaking, requiring careful consideration of various factors. Metrics such as job creation, capital investment, and overall economic output in the targeted sectors provide valuable insights into the impact of these programs. However, it's crucial to account for other factors that could influence these outcomes, such as broader economic trends, national policies, and even natural disasters. Determining a program's actual impact requires careful statistical analysis to account for these confounding variables and isolate the effect of the incentives.

A comprehensive evaluation should also examine the long-term impact of incentives, beyond the initial period of implementation. Sustained economic growth and job creation are critical indicators of a successful program. By analyzing the long-term consequences, policymakers can refine their incentive strategies and ensure they are aligned with the long-term goals of the region.

Beyond the Purchase: Exploring Charging Infrastructure Incentives

Unveiling the Hidden Value

Beyond the initial purchase price, the true value of a product often lies in the experiences and benefits it unlocks. This extends far beyond the tangible object itself, encompassing the service, support, and community that surrounds it. Examining this broader perspective allows us to understand the lasting impact a product can have on consumers.

Consider the satisfaction derived from a well-designed user interface, the ease of use, and the seamless integration with other products or services. These elements contribute significantly to the overall customer experience, which is often more valuable than the initial purchase itself.

The Ecosystem Effect

The 'ecosystem effect' plays a pivotal role in determining the long-term success of a product. This encompasses the entire network of interconnected elements, including developers, users, and support teams. A robust ecosystem fosters continuous innovation and improvement, benefiting both the product and its users.

Strong community engagement and active support forums are crucial components of a thriving ecosystem. They provide valuable feedback loops and avenues for problem-solving, ensuring that the product evolves to meet the specific needs of its users.

Customer Service and Support

Exceptional customer service and support are essential for fostering loyalty and positive word-of-mouth marketing. Prompt and helpful assistance can turn a frustrating experience into a positive one, solidifying customer satisfaction and creating a strong brand image.

Companies that prioritize customer support understand that resolving issues quickly and effectively is crucial for retaining customers. This proactive approach not only addresses immediate problems but also builds trust and strengthens the customer relationship.

The Long-Term Value Proposition

The long-term value proposition of a product extends beyond its initial functionality. It encompasses the ongoing benefits, such as updates, upgrades, and community engagement, that enhance the user experience over time. This approach ensures that the product remains relevant and valuable to its users for an extended period.

Community and Collaboration

A strong community surrounding a product fosters a sense of belonging and shared experience. Users can connect with each other, share tips, and collaborate on solutions, leading to a more enriching and rewarding experience for everyone involved.

This collaborative environment fosters innovation, as users share insights and ideas. This creates a dynamic feedback loop, ensuring that the product continuously adapts to evolving needs.

Beyond Material Gain: Emotional Connection

Products that resonate emotionally with users often hold a greater intrinsic value. This connection can stem from a feeling of empowerment, belonging, or even simple enjoyment. These intangible benefits elevate the product beyond a mere commodity, becoming a meaningful part of the user's life.

The Impact on User Experience

Ultimately, the value extends to the overall user experience. Factors like design, usability, and accessibility all contribute to a positive and enjoyable interaction with the product. A seamless user experience fosters engagement and encourages continued use.

A thoughtfully designed product goes beyond functionality; it shapes the way users interact with the world around them. By prioritizing intuitive design and user-centered features, businesses can elevate the value proposition far beyond the initial purchase.

Strategic Planning for Optimal Investment Returns

Understanding the EV Incentive Landscape

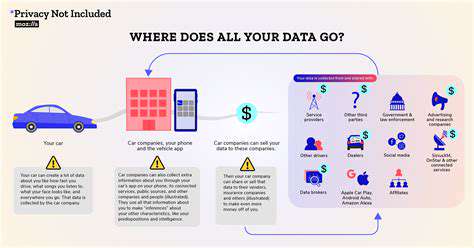

Government incentives and subsidies play a crucial role in driving the adoption of electric vehicles (EVs). These financial incentives can significantly reduce the cost of purchasing an EV, making them more accessible to a wider range of consumers. Understanding the various types of incentives available, their eligibility criteria, and how they differ across jurisdictions is essential for maximizing the value of an EV investment.

Examining the current state of EV incentives across different regions, including national and local programs, provides a comprehensive view of the financial support available. This analysis allows individuals and businesses to strategically plan their EV purchases and investments, taking advantage of the most advantageous incentives.

Analyzing EV Subsidies for Different Vehicle Types

Electric vehicles come in various forms, from compact cars to SUVs and trucks. The level of subsidy offered often varies based on factors like battery capacity, range, and vehicle type. For instance, incentives might be higher for EVs with a longer range or those utilizing innovative battery technologies. A thorough analysis of these distinctions is vital for calculating the true cost savings.

Comparing subsidies across different EV segments helps potential buyers identify the most cost-effective option. This comparison should consider both the initial purchase price reduction and any ongoing incentives like tax credits or rebates.

Evaluating the Impact of State and Local Incentives

Regional differences in EV adoption often correlate with varying levels of state and local incentives. These incentives can be a significant motivator for consumers in specific areas, driving local demand and fostering the development of charging infrastructure. Understanding the nuances of these programs is essential for making informed decisions.

Strategic Planning for Maximizing Tax Credits and Rebates

Navigating the complexities of tax credits and rebates is crucial to maximizing the financial benefits of purchasing an EV. Different jurisdictions offer varying tax credits and rebates, and understanding the specific requirements for each is important to ensure eligibility. Documentation and timely application are key components of this process.

Long-Term Financial Implications of EV Subsidies

The long-term financial implications of EV subsidies extend beyond the initial purchase price. These incentives can contribute to the overall affordability of electric vehicles over their lifespan. Analyzing the long-term cost savings, including potential reductions in fuel costs and maintenance expenses, is a crucial part of strategic planning.

Integration of EV Incentives into Investment Portfolios

For investors, understanding the impact of EV incentives on the market can be a critical factor. Strategic investment decisions may consider the potential growth of the EV market and the financial incentives driving this expansion. By incorporating this understanding into investment portfolios, investors can potentially capitalize on the long-term growth opportunities presented by the electric vehicle revolution.

Future Trends and Projections in EV Incentives

The future of EV incentives is constantly evolving. Predicting future trends in government support for electric vehicles is essential for long-term strategic planning. Staying informed about potential changes in policies, regulations, and incentives is essential for investors and consumers alike. Anticipating these changes can help maximize returns and adapt to the evolving market landscape.