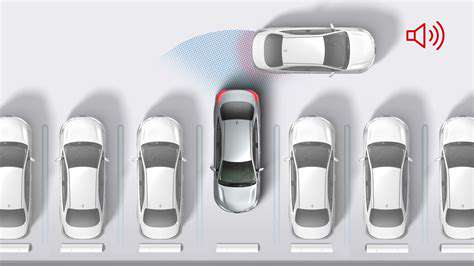

Tailored Coverage Based on Driving Habits

Personalized insurance premiums, fueled by advancements in connected car technology, offer a significant shift from traditional flat-rate pricing. This innovative approach allows insurance providers to analyze driver behavior in real-time, factoring in elements like acceleration, braking, speed, and route choices. This data-driven analysis enables the creation of customized premiums, reflecting the individual risk profile of each driver. Instead of a one-size-fits-all approach, drivers with demonstrably safer driving habits can potentially enjoy lower premiums, while those exhibiting more risky behaviors may face adjusted costs. This personalized approach promises a more equitable and accurate reflection of individual driving risk.

This dynamic adjustment is a key benefit of connected car insurance. Drivers who consistently demonstrate responsible driving habits, such as maintaining safe speeds and avoiding aggressive maneuvers, will see their premiums decrease. Conversely, drivers who exhibit more risky behaviors, like frequent hard braking or speeding, may find their premiums increase. This system promotes responsible driving behavior by making the cost of insurance directly correlate to individual driving performance.

Reduced Costs for Safe Drivers

One of the most compelling aspects of personalized insurance premiums is the potential for significant cost savings for safe drivers. By accurately assessing individual driving styles, insurance companies can identify and reward responsible behavior. This translates to lower premiums for drivers who consistently prioritize safety, which further incentivizes safer driving practices. This reward system not only benefits the individual driver but also contributes to a safer overall driving environment.

The ability to quantify safe driving habits directly leads to a more accurate assessment of risk. By analyzing real-time data from connected car technology, insurance companies can identify those drivers who consistently demonstrate safe behaviors, like maintaining a steady speed and avoiding aggressive driving. This detailed analysis allows for more accurate risk assessment compared to traditional methods, leading to lower premiums for safe drivers and fairer premiums for all.

Improved Accuracy in Risk Assessment

Traditional insurance models often rely on limited data points, such as age, location, and driving history. This can lead to inaccuracies in risk assessment, potentially overcharging safe drivers and undercharging those with higher risk profiles. Connected car insurance, through its real-time data collection, significantly improves the accuracy of risk assessment. By tracking driving behavior continuously, this technology provides a more comprehensive view of individual driving patterns, leading to more precise premium calculations.

The wealth of data collected by connected car technology allows for a more granular understanding of driving behavior. This detailed insight permits a more nuanced assessment of risk, reducing the potential for inaccurate pricing. Insurance companies can now tailor premiums to reflect the specific driving habits of each policyholder, leading to a fairer and more efficient insurance system.

Encouraging Safer Driving Behaviors

Personalized insurance premiums, in conjunction with connected car technology, foster a culture of safer driving. By directly linking premium costs to driving habits, drivers are incentivized to adopt safer driving practices. This system encourages cautious driving, reduces the likelihood of accidents, and ultimately promotes a safer road environment for everyone. This feedback loop helps drivers improve their driving behaviors over time, benefiting both the individual and society.

The direct correlation between driving behavior and insurance costs creates a powerful incentive for drivers to improve their driving habits. This dynamic system promotes a culture of safety and encourages drivers to make safer choices behind the wheel. By highlighting the cost implications of risky behaviors, connected car insurance can play a significant role in preventing accidents and improving overall road safety.

The Future of Connected Car Insurance and Driver Safety

The Rise of Telematics Data in Insurance

Connected car technology is rapidly changing the landscape of insurance, and telematics data is at the heart of this transformation. This data, collected from various sources within the vehicle, provides insurers with a wealth of information about driver behavior, including driving patterns, mileage, and even the frequency of hard braking or speeding. By analyzing this data, insurers can better assess risk and offer more personalized insurance products and premiums. This allows for a more accurate and nuanced understanding of individual driver behavior than traditional methods.

The potential for cost savings is significant. Insurers can identify and reward safe drivers, offering lower premiums based on their demonstrably safer driving habits. This approach not only benefits the driver but also helps insurers manage their risk more effectively, leading to a more sustainable and profitable business model.

Personalized Insurance Policies

The access to detailed driving data allows insurers to create truly personalized insurance policies. Instead of a one-size-fits-all approach, policies can be tailored to individual driving habits and risk profiles. This means that drivers who consistently demonstrate responsible driving behavior can benefit from lower premiums, while those who engage in risky driving practices may face higher premiums.

This personalization goes beyond just adjusting premiums. It could also include offering tailored safety features, such as discounts on safety equipment or access to driver training programs. Ultimately, this fosters a more proactive approach to promoting safe driving and reducing accidents.

The Impact on Claim Management

Telematics data plays a crucial role in claim management, enabling quicker and more accurate assessments of incidents. Data captured during an accident can provide valuable context, such as the speed and braking patterns leading up to the collision. This facilitates a more objective evaluation of fault and can contribute to faster claim processing, leading to a better customer experience.

This improved accuracy in claim assessments can lead to fairer and more efficient claim settlements. By minimizing discrepancies and reducing disputes, insurers can streamline operations and reduce the overall cost of claims. This is a significant advantage, particularly in cases where determining liability can be complex.

Safety Features and Driver Education

Connected car technology isn't just about insurance; it's about safety. The data collected can be used to identify high-risk driving behaviors in real-time, providing drivers with immediate feedback and potentially even intervention. This data-driven approach could lead to more proactive safety measures, such as alerts for speeding or aggressive braking maneuvers.

Beyond real-time feedback, the data can be used to develop targeted driver education programs. Insurers can identify common mistakes and tailor training to address specific weaknesses, potentially leading to a significant reduction in accidents. This proactive approach to driver education has the potential to create a safer driving environment for everyone on the road.