Federal Tax Credits for EVs

Federal tax credits are a cornerstone of EV adoption. These incentives often involve significant financial reductions for the purchase of new electric vehicles. The details of these credits can be complex, including requirements for battery production, vehicle characteristics, and income limits. Understanding these nuances is vital for consumers to maximize their savings and ensure eligibility for these substantial benefits.

Often, the federal government offers a tax credit for the purchase of a new electric vehicle. The specific amount of the credit can vary depending on several factors, such as the vehicle's battery capacity and the manufacturer. These incentives can result in substantial savings for consumers, making electric vehicles more accessible and competitive with traditional gasoline-powered cars.

The Impact of Federal Incentives on EV Adoption

Federal incentives play a critical role in driving the adoption of electric vehicles. By lowering the overall cost of ownership, these incentives encourage consumers to make the switch to cleaner transportation options. This, in turn, fosters the growth of the electric vehicle market and accelerates the transition to a more sustainable transportation system.

The impact of federal incentives on EV adoption is substantial. The availability of these financial benefits motivates consumers to consider electric vehicles, leading to increased demand and sales. This positive feedback loop fuels further innovation and development within the EV industry.

Eligibility Criteria and Limitations

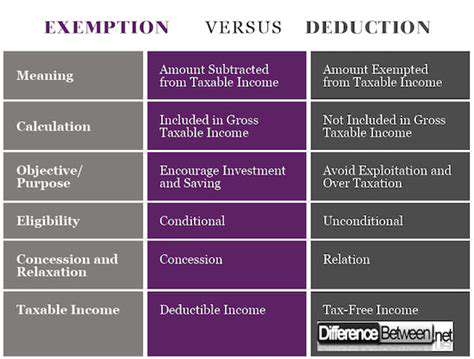

Eligibility for federal EV tax credits often comes with specific criteria. These criteria can include the vehicle's battery capacity, the manufacturer's production location, and the consumer's income level. Compliance with these requirements is crucial for claiming the credit and receiving the intended financial benefits.

Understanding the limitations of these incentives is also important. Sometimes, the credit amount might be reduced or even eliminated if certain conditions aren't met. Thorough research and careful consideration of the eligibility criteria are essential for maximizing the benefit of these federal incentives.

Historical Trends and Evolution of Federal Incentives

Federal incentives for electric vehicles have evolved over time, reflecting changing government priorities and technological advancements. Initial programs have been refined and expanded to adapt to the increasing popularity and sophistication of electric vehicles. These changes reflect a commitment to fostering cleaner transportation options.

The evolution of federal incentives is crucial to understanding the current landscape of EV adoption. Tracing the historical trends reveals the government's evolving approach to supporting the shift towards electric vehicles, showcasing a commitment to sustainability and technological advancement in transportation.

Potential Challenges and Future Considerations

Despite the benefits, there are potential challenges associated with federal EV incentives. Maintaining the effectiveness of these programs while adapting to future technological advancements and consumer preferences is crucial. One potential challenge is ensuring that the incentives remain competitive with the evolving market. Another consideration is the long-term sustainability of these programs.

The future of federal incentives for electric vehicles hinges on several factors. Predicting the future trajectory of these incentives requires understanding the evolving landscape of the automotive industry, consumer preferences, and technological advancements. These factors will influence the design and implementation of future programs aimed at fostering the adoption of cleaner transportation.

Coordination with State and Local Incentives

Federal incentives often work in conjunction with state and local programs. A comprehensive understanding of the interplay between these different levels of government support is vital for maximizing the benefits of electric vehicle ownership. By coordinating these efforts, a more robust and impactful support system can be created for consumers interested in making the switch to electric vehicles.

The combined effect of federal, state, and local incentives can create a powerful financial incentive for electric vehicle adoption. Understanding how these different levels of government support interact is crucial for maximizing the benefits and ensuring a smooth transition to a cleaner transportation system.

State-Level Programs: A Patchwork of Policies

State-Level Initiatives: A Diverse Landscape

State-level policies regarding electric vehicle (EV) incentives demonstrate a significant degree of variation across the United States. This patchwork of programs reflects differing priorities, economic conditions, and environmental concerns within individual states. Some states have aggressively pursued robust incentives to accelerate EV adoption, while others have adopted more cautious approaches, leading to a complex and dynamic landscape for EV purchasers.

Tax Credits and Rebates: A Key Driver

Many states offer tax credits or rebates to incentivize the purchase of EVs. These financial incentives can significantly reduce the overall cost of an EV, making them more competitive with traditional gasoline-powered vehicles. The specific amounts and eligibility criteria for these credits and rebates vary substantially between states, impacting the overall effectiveness of the incentive programs.

Charging Infrastructure Development: Supporting the Ecosystem

Beyond direct purchase incentives, states are also investing in the development of public EV charging infrastructure. This includes building charging stations along highways, in urban centers, and at other key locations. The presence of readily available charging options is crucial to increasing EV adoption, as it addresses concerns about range anxiety and the availability of charging facilities. States are recognizing the importance of a well-developed charging network to support the wider adoption of EVs.

Purchase Incentives for Specific Models or Classes

Some states have implemented purchase incentives that are targeted towards specific EV models or classes. For example, a state might offer a larger incentive for the purchase of a battery electric vehicle (BEV) compared to a plug-in hybrid electric vehicle (PHEV). Such targeted incentives can encourage consumers to choose EVs with certain technological advancements or characteristics.

Financial Support for EV Charging at Home

Recognizing that home charging is often a crucial factor for EV adoption, some states offer financial assistance for the installation of home EV charging stations. This support can reduce the upfront cost of installing home charging equipment, making EVs more accessible and practical for everyday use. These programs are essential in making EV ownership more convenient and less financially burdensome.

Renewable Energy Integration: A Synergistic Approach

Several states are integrating EV incentives with policies promoting renewable energy sources. This synergistic approach recognizes the interconnectedness of the electric vehicle market and the broader energy sector. By supporting both EV adoption and renewable energy production, states can work towards a more sustainable transportation and energy future. This alignment of policies can create a virtuous cycle, fostering economic growth and environmental protection.

Addressing Equity Concerns: Targeted Programs

Some states are proactively addressing equity concerns related to EV ownership. These initiatives recognize that lower-income communities may face barriers to accessing EV technologies and benefits. Targeted programs might include financial assistance for low-income households or educational initiatives to increase awareness and knowledge of EV options. These efforts aim to ensure equitable access to the benefits of EV technology for all segments of society.

Local Government Initiatives: Supporting Infrastructure and Communities

Local Government Initiatives: Supporting Community Development

Local governments play a crucial role in fostering community development by implementing various initiatives. These initiatives aim to address specific needs and challenges within their jurisdiction, improving the overall quality of life for residents. Effective community development strategies are often tailored to the unique characteristics and priorities of each community, recognizing that one-size-fits-all approaches rarely yield optimal results.

By investing in community infrastructure, providing accessible services, and promoting economic opportunities, local governments can create thriving and resilient communities. This involves considering the needs of diverse populations and ensuring equitable access to resources for all residents, regardless of background or socioeconomic status.

Community Infrastructure Development

Investing in community infrastructure is paramount to supporting local development. This includes upgrading existing roads, parks, and public facilities, as well as constructing new ones to meet growing community needs. Well-maintained infrastructure contributes to a positive image of the community and encourages economic growth. This investment often leads to improvements in the overall quality of life for residents.

Proper infrastructure planning and management are essential to ensure long-term sustainability and effectiveness. This involves considering factors like environmental impact, community input, and future growth projections.

Economic Development Initiatives

Local governments can stimulate economic growth through various initiatives, such as attracting businesses, supporting entrepreneurship, and creating job training programs. These efforts can lead to increased employment opportunities and higher incomes for residents. Economic development often brings in new businesses, which can boost the local tax base and provide additional revenue for government services. This can have a profound impact on the overall health of a community.

Affordable Housing Programs

Addressing the housing needs of residents is a critical aspect of community development. Local governments can implement programs aimed at increasing affordable housing options, such as subsidies for low-income families and incentives for developers to build affordable units. Accessible housing significantly improves the quality of life for residents by reducing housing insecurity and stress.

These programs not only provide immediate relief to those struggling with housing costs but also contribute to the long-term stability and well-being of the community as a whole.

Public Health Initiatives

Promoting public health is an essential component of community development. Local governments can invest in programs that improve access to healthcare, encourage healthy lifestyles, and address health disparities within the community. These initiatives often lead to improved overall health outcomes and a reduction in the burden of chronic diseases.

Environmental Sustainability Efforts

Environmental sustainability is increasingly important in community development. Local governments can implement programs that promote green spaces, reduce pollution, and conserve natural resources. These initiatives not only protect the environment but also create healthier and more enjoyable living spaces for residents.

Sustainable practices contribute to the long-term well-being of the community and its environment. They also often generate economic opportunities in green industries.

Community Engagement and Participation

Successful community development hinges on active engagement and participation from residents. Local governments should foster a culture of collaboration and communication by creating platforms for residents to voice their concerns, share ideas, and contribute to decision-making processes. This approach ensures that development initiatives are responsive to the needs and priorities of the community.

Transparent and inclusive participation helps build trust and strengthens the sense of community ownership, making development efforts more effective and sustainable.

Regional and Community-Specific Programs: Beyond the State Level

Regional Variations in Practices

Understanding regional differences in practices is crucial for effective community engagement. Different communities often have unique cultural norms, historical contexts, and socioeconomic factors that shape their approaches to various issues. For instance, a program designed for a rural community might need to address access to transportation or local resources, while an urban program could focus on issues like affordable housing or public safety.

Examining these regional nuances allows for the development of more tailored and impactful interventions. This targeted approach can lead to higher rates of engagement and success compared to a one-size-fits-all strategy. It's essential to recognize that a single framework won't effectively address the multifaceted needs of every community.

Community-Specific Needs and Priorities

Identifying and prioritizing community-specific needs is paramount to successful interventions. This involves actively listening to and engaging with community members to understand their perspectives, concerns, and priorities. A thorough needs assessment is key to understanding the unique challenges and opportunities within each community.

Community members often possess deep knowledge and insights into their own circumstances. Their input is invaluable in shaping programs that are truly relevant and responsive to their needs. By prioritizing these locally identified needs, the effectiveness and sustainability of programs can be significantly enhanced.

Historical Context and its Impact

The historical context of a community plays a significant role in shaping its present-day needs and challenges. Understanding past events, social movements, and historical injustices can help to inform interventions that address the root causes of persistent problems. For example, historical patterns of discrimination can contribute to disparities in access to resources and opportunities.

Recognizing and acknowledging this historical context is essential for creating equitable and effective programs. A thorough understanding of the past can help to build trust within the community and foster a sense of shared responsibility.

Cultural Sensitivity and Respect

Cultural sensitivity and respect are essential components of any successful community engagement initiative. Understanding and appreciating different cultural norms, values, and beliefs is crucial for building rapport and trust. Misunderstandings can arise easily if cultural nuances are not considered.

Effective communication strategies that prioritize cultural sensitivity are key to success. It is imperative to avoid imposing external perspectives or assumptions about the community and instead to prioritize the knowledge and experiences of the community members themselves.

Engagement Strategies and Methods

Developing effective engagement strategies is vital for community participation in programs. This may involve utilizing diverse communication channels, organizing community meetings, and leveraging existing community networks. It's important to tailor strategies to the specific needs and preferences of the community.

The effectiveness of community-based approaches hinges on active engagement and participation. Engaging community members in the design, implementation, and evaluation processes can lead to more sustainable and impactful outcomes. This fosters a sense of ownership and strengthens the collective commitment to achieving shared goals.

Data Collection and Analysis for Informed Decision Making

Collecting and analyzing accurate data is essential to understanding community needs and evaluating the effectiveness of interventions. This includes gathering data on demographics, socioeconomic factors, access to resources, and community priorities. Various data collection methods, including surveys, interviews, and focus groups, should be employed.

Thorough data analysis informs program adjustments and ensures that interventions are responsive to evolving community needs. This process allows for ongoing evaluation and improvement, ultimately leading to more effective and sustainable programs. Data-driven decision-making ensures that interventions remain aligned with community priorities and challenges.

Maximizing Savings: Combining Federal, State, and Local Incentives

Maximizing Savings Through Strategic Federal Tax Credits

Federal tax credits offer significant opportunities for individuals and businesses to reduce their tax burden and potentially increase their savings. Understanding the various types of credits available, such as the child tax credit, the earned income tax credit, and energy-efficient home improvements credit, can be crucial in maximizing financial benefits. Careful planning and proper documentation are essential for accurately claiming these credits and avoiding potential issues with the IRS. Navigating the complexities of the tax code can be challenging, but utilizing reliable resources, such as tax professionals and government websites, can greatly improve the chances of successfully claiming these credits. This proactive approach allows taxpayers to potentially save hundreds or even thousands of dollars, which can be reinvested or used to achieve personal financial goals.

Many federal tax credits are designed to encourage specific behaviors or investments, such as investing in renewable energy sources or adopting energy-efficient home improvements. These incentives are vital for fostering economic growth and promoting sustainable practices. Identifying eligible credits based on individual circumstances and financial goals is key to maximizing savings. Furthermore, understanding the specific requirements and limitations for each credit is important to ensure a successful claim. Regularly reviewing updated tax laws and regulations is crucial to stay informed on any changes that may affect eligibility or claim amounts.

Combining Federal Tax Credits with Other Financial Strategies

Maximizing savings often involves a comprehensive approach, combining federal tax credits with other financial strategies. For example, strategic budgeting and expense tracking can help individuals and businesses identify areas where savings can be made, which can then be further leveraged by claiming eligible tax credits. Combining these techniques leads to a more well-rounded approach to financial planning. This holistic strategy allows individuals to gain a deeper understanding of their financial position and make informed decisions about their finances.

Beyond simply claiming tax credits, exploring additional financial strategies, such as retirement savings plans, investment opportunities, and debt reduction plans, can significantly enhance overall financial well-being. These strategies, when combined with the potential savings from federal tax credits, create a potent synergy for achieving long-term financial success. By strategically combining these various approaches, individuals can build greater wealth and security. This proactive approach allows for a more comprehensive management of personal finances.

Furthermore, seeking professional financial advice can provide valuable insights into optimizing the use of federal tax credits within a broader financial plan. A qualified financial advisor can help identify potential synergies between tax credits and other investments, providing a personalized roadmap for achieving financial goals. This personalized approach allows for a tailor-made strategy that is aligned with individual circumstances and financial objectives.