Eligibility Criteria for EV Tax Credits

Determining eligibility for federal tax credits for electric vehicles (EVs) involves a multifaceted assessment of the vehicle's characteristics, the buyer's circumstances, and the specific programs in place. Crucially, the vehicle must meet stringent requirements regarding battery capacity and manufacturing origin to qualify. This ensures that the credits are targeted towards vehicles that genuinely contribute to the nation's transition to electric transportation. Furthermore, buyers must meet specific income thresholds, and the vehicle must not be primarily used for commercial purposes. Detailed information and updated guidelines are essential for a comprehensive understanding of these requirements.

The specifics of income limitations and other eligibility criteria can vary depending on the particular tax credit program. Understanding these nuances is critical to avoid potential disqualification and maximize the benefit of these valuable financial incentives. Thorough research and consultation with tax professionals are highly recommended to ensure a smooth and accurate application process.

Types of EV Tax Credits Available

The federal government offers a variety of tax credits designed to incentivize the purchase of electric vehicles. These credits often vary in terms of their specific stipulations and the type of vehicle they cover. For example, some credits are specifically targeted at battery electric vehicles (BEVs), while others may encompass plug-in hybrid electric vehicles (PHEVs). The details of these credits, and their eligibility requirements, are constantly evolving, so staying informed is crucial.

Understanding the different types of credits and their respective eligibility requirements is essential to ensure you're claiming the most appropriate and beneficial incentives. This can include credits for the purchase price, credits for the installation of charging stations, and potentially even credits for the purchase of certain EV charging equipment. The specific nature of these credits can vary, so meticulous research is key.

Impact on the Automotive Industry

Federal tax credits for EVs have had a significant and positive impact on the automotive industry, boosting demand for electric vehicles and incentivizing manufacturers to invest in developing and producing more environmentally friendly options. This investment in EV technology is crucial for the long-term sustainability of the automotive sector. The credits are a powerful tool in fostering innovation and competition within the industry, accelerating the transition towards a greener transportation landscape.

The credits have spurred significant advancements in battery technology, electric motor efficiency, and vehicle design. This acceleration of innovation has the potential to revolutionize the automotive industry and position the United States as a leader in sustainable transportation solutions. Consequently, the industry is experiencing a rapid shift in its product offerings and manufacturing strategies, all in response to these government incentives.

Considerations for EV Buyers

Potential EV buyers should carefully consider the implications of these tax credits before making a purchase. The credits can significantly reduce the overall cost of an EV, making it a more attractive option compared to traditional gasoline-powered vehicles. It's important to understand that the tax credits are only available for a limited time and are subject to change.

Moreover, buyers need to factor in the potential complexities of claiming the credits on their tax returns. Seeking professional guidance from tax advisors or financial experts is strongly recommended to navigate this process successfully and ensure maximum benefit. Understanding the intricate details of the application process, and the potential eligibility criteria, is essential for a smooth and effective claiming process.

Future Outlook of EV Tax Credits

The future of federal tax credits for EVs is uncertain, but the ongoing need for environmentally friendly transportation solutions suggests a continued role for these programs. Government policies are likely to evolve in response to technological advancements, market trends, and changing environmental concerns.

Continued research and analysis of the impact of these credits on both the automotive industry and the environment are crucial in shaping future policies. The potential for adjustments or refinements to the existing programs, based on performance data and evolving needs, is likely. Staying informed about potential changes will be critical for individuals and businesses seeking to leverage these incentives.

State and Local EV Incentives: A Regional Perspective

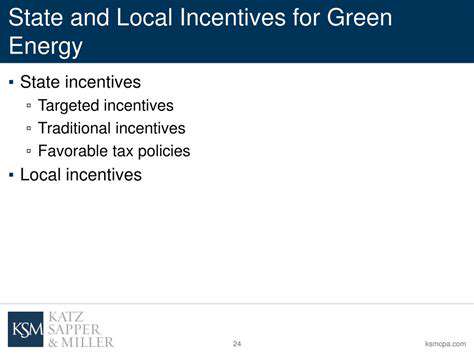

State EV Incentive Programs

State governments across the nation are actively implementing various programs to encourage electric vehicle (EV) adoption. These incentives often include tax credits, rebates, and grants for the purchase or installation of charging infrastructure. Understanding these programs is crucial for consumers, as they can significantly reduce the cost of transitioning to electric vehicles. Moreover, these programs play a vital role in fostering a robust EV market and supporting the development of a sustainable transportation system. Many states offer incentives for purchasing new electric vehicles and installing home charging stations.

Specific incentives vary considerably from state to state. Some states may offer substantial tax credits for the purchase of a new EV, while others may focus on supporting the development of public charging stations. A comprehensive understanding of these variations is essential for consumers to maximize the benefits of available incentives. The availability and value of these incentives can change over time, so it's crucial for potential buyers to stay informed about the latest regulations and programs offered by their respective state governments.

Local Government EV Initiatives

Local governments are also increasingly recognizing the importance of promoting electric vehicle adoption within their communities. These initiatives often focus on expanding public charging infrastructure, creating dedicated parking spaces for EVs, and implementing policies that encourage the use of electric vehicles within their jurisdictions. Local regulations and policies can significantly impact the practicality and accessibility of EVs for residents.

Many local governments are collaborating with businesses and community organizations to establish charging stations in public spaces, such as parking garages, libraries, and community centers. This collaboration is essential to ensure that EV charging infrastructure is accessible and convenient for everyone. These efforts often aim to create a more sustainable and environmentally friendly transportation system for the community. The initiatives are often tailored to the specific needs and characteristics of the local area.

Impact on EV Market and Sustainability

The combined effect of state and local EV incentives is substantial in shaping the electric vehicle market and supporting sustainability efforts. These programs, whether through tax credits, rebates, or grants, directly influence consumer purchasing decisions and encourage the adoption of electric vehicles. The collective impact of these initiatives fosters a positive feedback loop, driving innovation in the electric vehicle industry and supporting the development of a more sustainable transportation system.

These incentives play a key role in accelerating the transition to electric vehicles by mitigating the financial barrier to entry. By reducing the cost of EV ownership, these programs encourage broader adoption, leading to a decrease in greenhouse gas emissions and a more sustainable transportation future. The combined effort is essential in achieving ambitious environmental goals and fostering a more eco-conscious future.

Early detection and prevention strategies are crucial in the fight against cancer. Investing in research focused on identifying biomarkers and developing screening tools for various cancers can significantly improve survival rates. Early detection allows for timely intervention, often resulting in more effective treatment options and improved patient outcomes. This includes supporting research into genetic predispositions to cancer, enabling personalized screening protocols tailored to individual risk factors. Such initiatives are vital for reducing the burden of cancer on individuals and society as a whole.

Important Considerations for Maximizing Benefits

Understanding the Eligibility Criteria

Navigating the intricacies of EV incentives and tax credits often hinges on understanding the eligibility criteria. This involves a thorough assessment of factors like vehicle type, manufacturer, battery capacity, charging infrastructure, and specific state or local regulations. For instance, some incentives might be exclusive to electric vehicles built within a particular region, or those meeting specific performance or range standards. Knowing these nuances is crucial for maximizing the financial benefits available and ensuring you're not overlooking potential savings opportunities.

Furthermore, eligibility criteria can be quite specific. It's important to not just look at the general requirements, but to meticulously check if your particular vehicle, location, and personal circumstances meet all the necessary conditions. This could involve researching the specific requirements of the tax credit program, reviewing manufacturer specifications, or consulting with a financial advisor who understands the intricacies of EV incentives.

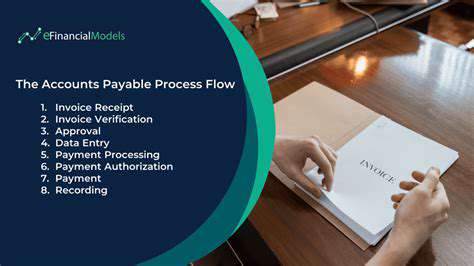

Maximizing Tax Credits Through Documentation

Thorough record-keeping is paramount when claiming EV incentives and tax credits. This includes meticulously documenting all relevant purchase details, such as the purchase date, the seller's information, the VIN number, and the specific features or specifications of the vehicle. Maintaining this detailed documentation will be invaluable during audits and can prevent potential delays or denials when applying for or claiming the credits.

Properly organizing receipts, invoices, and any supporting paperwork is essential. A well-maintained and easily accessible file system will make the process of claiming your credits much smoother and more efficient. This careful organization can save you time and headaches down the road, ensuring a more streamlined application process for claiming your incentives and tax credits.

Leveraging Resources for Support and Guidance

Numerous resources are available to help individuals navigate the complexities of EV incentives and tax credits. These resources can provide valuable guidance, clarification, and support throughout the entire process. Government websites, dedicated EV advocacy groups, and financial advisors specializing in green investments can provide insights into the specific regulations and requirements in your area. These resources can help you understand the different programs, the applicable rules, and the steps involved in claiming the incentives.

Taking advantage of these resources is key to successfully maximizing the benefits of EV incentives and tax credits. Engaging with these platforms and advisors can illuminate the nuances of each program and ensure you're making informed decisions that maximize your financial gains. This proactive approach will empower you to secure the best possible financial benefits from the incentives and credits available.