Understanding the Fundamentals of Bank Loans

Bank loans serve as vital financial instruments for both businesses and individuals needing capital for diverse objectives, from acquiring equipment to financing growth initiatives. Grasping the nuances of bank loans is key to making well-informed choices. This demands careful attention to interest rates, repayment schedules, and the total borrowing expenses. Equally important is comprehending the loan application procedure and the lender's prerequisites to ensure a favorable result.

Submitting a loan application usually entails providing comprehensive financial records and a detailed plan for fund utilization. Lenders evaluate the borrower's credit history and financial health to ascertain the loan's feasibility. This scrutiny helps them determine the probability of timely repayment as stipulated in the agreement.

Exploring the Various Types of Bank Loans

The financial sector presents a wide range of bank loans tailored to different requirements and scenarios. For instance, small business loans are specifically crafted to support entrepreneurs and small enterprises in reaching their expansion targets. These loans frequently feature adaptable terms to suit the distinct needs of smaller businesses.

Another significant category is the mortgage loan, which facilitates home purchases. Mortgage loans generally span long durations, with repayment periods extending over multiple decades. These loans are customized to meet the specific demands of homebuyers and are often backed by the property itself.

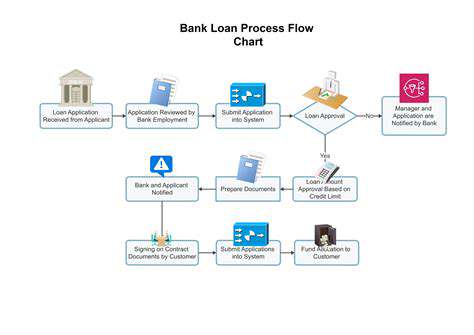

Navigating the Loan Application Process

The loan application journey can be intricate, involving multiple stages and criteria. It's imperative to meticulously follow the lender's instructions and meet all requirements to streamline the process. The precision and thoroughness of the submitted paperwork are pivotal for the lender's evaluation. A meticulously prepared application substantially boosts the likelihood of approval.

Being well-prepared and fully aware of the application steps can significantly alleviate the stress and time involved in securing a bank loan. This includes compiling all essential financial documents and familiarizing oneself with the lender's benchmarks.

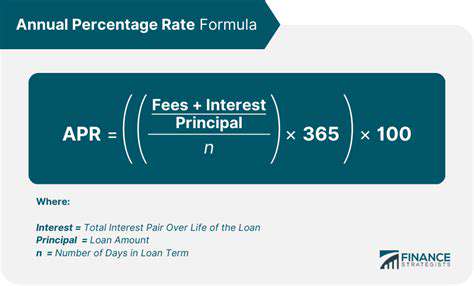

Assessing Loan Terms and Conditions

Scrutinizing the loan's terms and conditions is essential before finalizing any agreement. Grasping the interest rate, repayment plan, and any additional fees is crucial. This detailed analysis enables borrowers to weigh different loan options and choose the most beneficial one.

Loan terms and conditions can profoundly influence the total borrowing cost. Being vigilant about prepayment penalties, late fees, and other charges is indispensable. This proactive stance ensures borrowers are fully informed about all potential expenses tied to the loan.

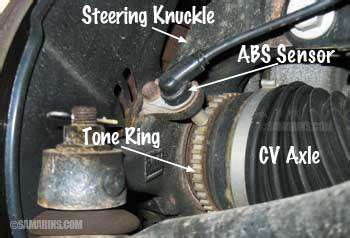

Understanding Loan Security and Collateral

Numerous bank loans necessitate collateral, which acts as a safeguard for the lender. This collateral can encompass various assets, such as real estate or vehicles. Recognizing the ramifications of pledging collateral is vital to sidestep any financial pitfalls.

The Importance of Creditworthiness

Creditworthiness is a cornerstone in obtaining a bank loan. A robust credit history signals responsible financial behavior to lenders. This underscores the borrower's dependability and capacity to adhere to the repayment schedule. A favorable credit score not only enhances approval odds but often secures more attractive loan terms.

Cultivating a solid credit history through prudent financial habits is fundamental for future financial undertakings. This forward-thinking approach paves the way for successful loan applications and sustained financial health.

Factors Influencing Loan Approval

Several elements shape a lender's decision to greenlight a loan application. These include the borrower's credit score, debt-to-income ratio, and overall financial standing. A sound financial profile markedly improves approval prospects.

Lenders also weigh the loan's purpose, the requested amount, and the repayment conditions. Familiarity with these aspects is crucial for borrowers aiming to refine their loan applications.

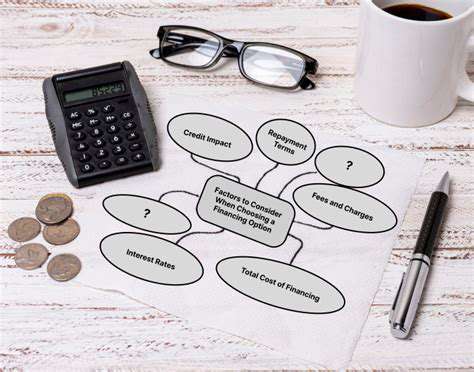

Factors to Consider When Choosing Your Financing Option

Location, Location, Location

Selecting an optimal location for your venture is critical, as it directly influences accessibility, resources, and overall success. Being close to essential services, infrastructure, and skilled labor can drastically affect both timeline and budget. Conducting in-depth research on zoning laws, environmental assessments, and local demographics is imperative before settling on a site. Additionally, gauging the local market and competitive landscape is key for enduring sustainability and profitability. Easy access to transport and communication networks minimizes logistical hurdles and enhances operational efficiency.

Budget Constraints and Financial Projections

Creating a realistic and comprehensive budget is foundational for any project. This entails detailing all potential expenses, from initial setup to ongoing upkeep. Precise financial forecasts are indispensable for securing funding and guiding decisions throughout the project. Evaluating the expected return on investment (ROI) and potential pitfalls is essential for maintaining financial health and long-term success. Exploring various funding avenues, including loans, grants, and investor capital, should be part of the overarching financial strategy.

Project Timeline and Milestones

Establishing a clear project timeline is vital for effective management. This involves setting achievable deadlines, marking key milestones, and allocating resources wisely. A well-defined timeline aligns expectations and ensures all stakeholders remain synchronized. Meticulous planning facilitates efficient resource distribution and proactive risk management. Anticipating possible delays and crafting backup plans helps keep the project on track.

Risk Assessment and Mitigation Strategies

Identifying and evaluating potential risks is a cornerstone of project planning. A comprehensive risk assessment enables the anticipation of challenges and the development of strategies to mitigate their impact. This forward-looking approach fosters resilience and adaptability in the project plan. Factors such as market volatility, regulatory shifts, and technological advancements must be considered to formulate robust risk management plans. This involves assessing threats and devising contingency measures to address them effectively.

Team Composition and Expertise

Building a competent and experienced team is crucial for project success. Determine the specific skills and knowledge required for each phase of the project. Selecting individuals with the right expertise and background is fundamental for smooth execution and positive results. This process includes hiring suitable candidates, establishing clear communication, and nurturing a collaborative atmosphere. Fostering a supportive team environment boosts morale and sustains productivity throughout the project.

Quality Control and Standards

Implementing stringent quality control measures is essential for achieving desired outcomes. This involves setting clear quality benchmarks, conducting thorough testing, and ensuring compliance with relevant regulations. Upholding high-quality standards is vital for customer satisfaction and maintaining a strong reputation. Ensuring all deliverables meet established criteria and adhere to industry best practices is key to successful project completion. Incorporating feedback mechanisms and continuous improvement processes enhances future project performance.