Unrealistic Prices and Incentives

One of the most prominent red flags in a car buying scam is an offer that seems too good to be true. Dealerships often advertise incredibly low prices or enticing incentives, such as ridiculously low interest rates, or seemingly generous rebates. Be skeptical if the advertised price is significantly lower than market value for a comparable vehicle. Investigate the advertised incentives thoroughly. Verify the terms and conditions associated with the incentives, as sometimes they come with hidden catches or limitations. This is crucial to avoid being trapped in a deal that appears attractive but ultimately costs more than expected in the long run.

A salesperson might pressure you into accepting a deal on the spot, making you feel pressured to act quickly. While some deals are time-sensitive, a genuine dealership will allow you time to consider the offer and fully understand the terms. Don't be afraid to walk away if the price or incentives seem too good to be true; it's often a sign that something isn't quite right.

Hidden Fees and Add-ons

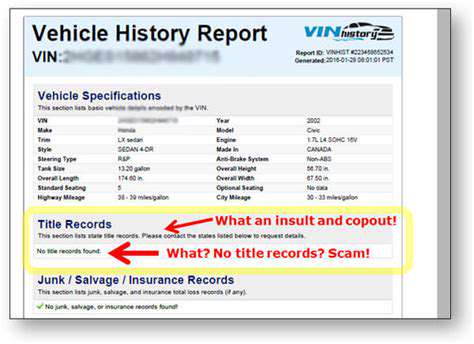

Beware of dealerships that present a seemingly attractive base price but then add numerous hidden fees or mandatory add-ons. These hidden costs can significantly inflate the final price of the vehicle, making the deal less appealing. Thoroughly review the entire contract before signing, looking for any fees or add-ons that weren't initially disclosed or weren't part of the initial agreement. Don't hesitate to ask questions about any fees or charges you don't understand. A reputable dealership will be transparent about all costs.

Sometimes, these hidden fees can be disguised as service charges, processing fees, or documentation fees. Always scrutinize these charges and demand clarification if they seem excessive or unclear. A good approach is to compare the advertised price against similar vehicles from reputable dealerships to ensure that the final price is fair and reasonable. This comparison will help you spot potential scams involving hidden fees.

Suspicious Financing and Trade-In Practices

Be cautious of dealerships that aggressively push a specific financing option, especially if it seems unusually high-interest or has unusual terms. This is a common tactic used in car buying scams. Do your research and compare financing options from multiple lenders to get the best possible deal. Never agree to a financing plan without thoroughly understanding the interest rates, repayment terms, and any associated fees. Avoid rushing into a decision; take your time to compare and negotiate.

Similarly, be wary of overly generous trade-in valuations. If the trade-in value offered is significantly higher than what independent online valuations suggest, it could be a red flag. Get a professional appraisal of your trade-in vehicle before entering into any negotiations to ensure a fair assessment. Don't be pressured into accepting a low trade-in value to finalize a deal, as this could lead to financial loss.

The Ghost of the Financing Company: Identifying Fictitious Lenders

The Unseen Hand of Capital

The financing company, often operating behind the scenes, plays a crucial role in shaping the economic landscape. Their influence, though subtle, is far-reaching, impacting everything from individual consumer choices to the trajectory of entire industries. This unseen hand of capital, with its intricate network of loans and investments, moves vast sums of money and steers the course of commerce.

Understanding the financing company's role is essential to grasping the complexities of modern finance. Their strategies, often veiled in financial jargon, have a profound effect on the way businesses operate and consumers spend. This unseen force shapes the very fabric of our economic lives.

The Shadowy Operations

The financing company's operations are often shrouded in secrecy, with many of their transactions and agreements remaining hidden from public view. This lack of transparency can create an environment where unethical practices and predatory lending become more prevalent.

This shadowy veil of secrecy can be concerning to both borrowers and investors, as it can make it difficult to assess the true risks and rewards of financial dealings. Transparency and accountability are vital in the financial sector to foster trust and prevent potential harm.

The Impact on Borrowers

For borrowers, the financing company can be a lifeline in times of need, providing access to capital for various purposes, such as starting a business or purchasing a home. However, the terms and conditions of these loans can often be complex and challenging to navigate, leaving borrowers vulnerable to unfavorable outcomes.

Borrowers need to thoroughly understand the terms of any loan agreement before signing, to avoid potentially devastating financial consequences down the line. Financial literacy plays a critical role in ensuring that borrowers make informed choices and protect themselves from predatory lending practices.

The Role in Economic Growth

Despite the potential for negative consequences, the financing company plays a vital role in fostering economic growth by providing capital to businesses that might not otherwise have access to funding. This injection of capital can stimulate innovation and job creation, leading to a positive ripple effect throughout the economy.

The provision of capital to small businesses and entrepreneurs can be instrumental in driving economic development and creating new opportunities. This can lead to greater prosperity and improved living standards for individuals and communities.

The Risks and Rewards

The financing company's activities are inherently intertwined with risk. The potential for profit is considerable, but so too is the possibility of significant losses if investments are mismanaged or if economic conditions shift unexpectedly. The inherent risk is significant, and careful management is crucial to mitigating potential harm.

Understanding the intricate balance between risk and reward is paramount for successful financial management. Investors and borrowers must weigh the potential benefits against the associated dangers before engaging in any transaction.

Ethical Considerations

As the financial landscape becomes increasingly complex, ethical considerations surrounding the financing company's operations become paramount. Issues such as predatory lending, misrepresentation of financial products, and lack of transparency raise serious concerns about the fairness and integrity of the financial system.

Maintaining ethical standards within the financing industry is crucial for the health of the financial system as a whole. Strong regulations and oversight are necessary to ensure that these institutions operate in a manner that benefits both borrowers and investors.

The Future of Financing

The future of financing is likely to be shaped by technological advancements and evolving consumer expectations. Innovative financial technologies, such as online lending platforms and mobile payment systems, are transforming the way capital is accessed and managed.

Adaptability and innovation are critical for the financing industry to remain relevant and meet the changing needs of the modern economy. Embracing these advancements while maintaining ethical practices will be key to the continued success and stability of the financial sector.